HerAurum by Aureva

Your “Aura” defines you and your unique powerful essence. It tells the story of your resilience, your strength, your choices and the path you took.

Her Power. Her Wealth. Unlocked.

Partnering in her path to financial freedom

HerAurum is our exclusive advisory service, essentially built on the belief that your financial architecture must dynamically mirror your inherent vision, resilience, and uniqueness

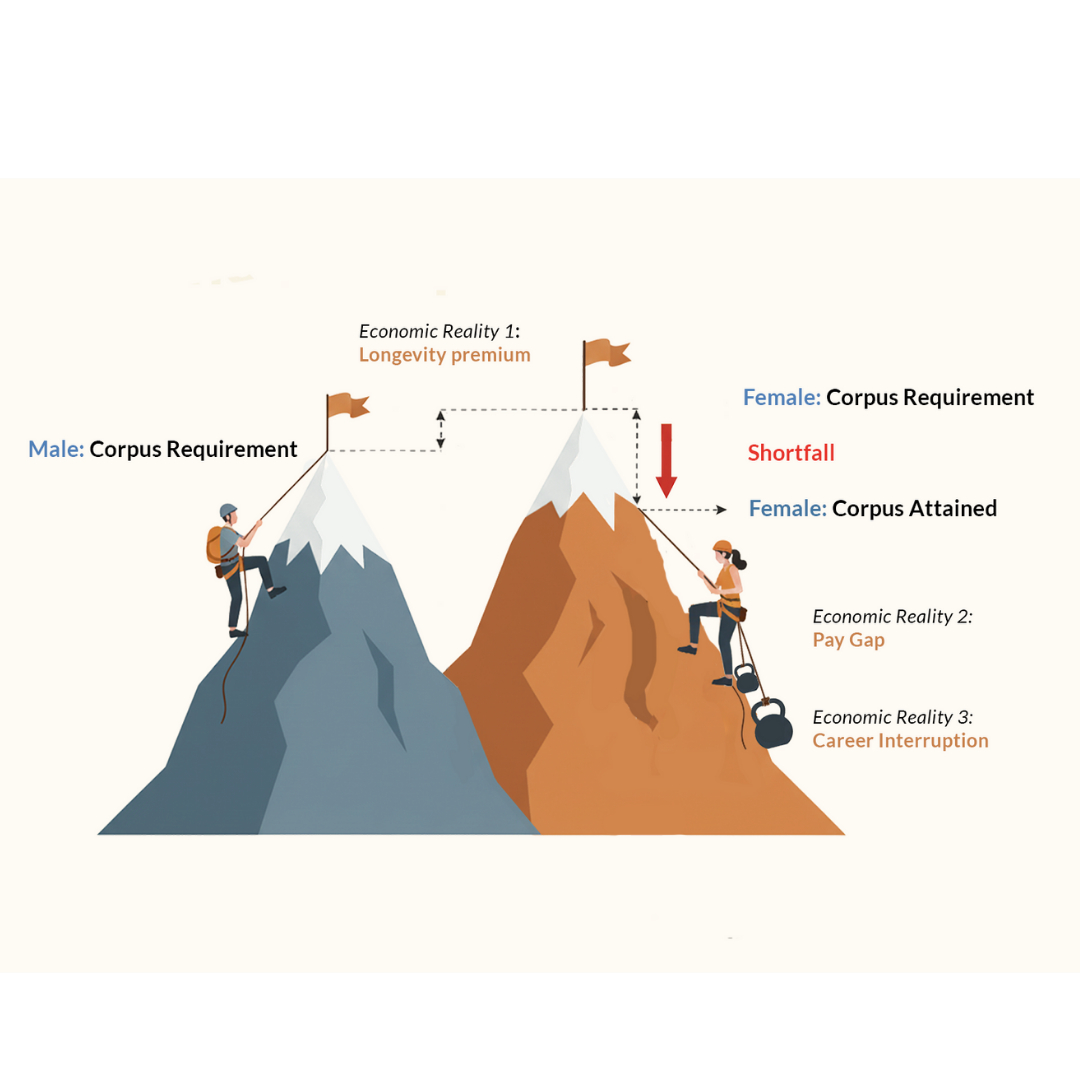

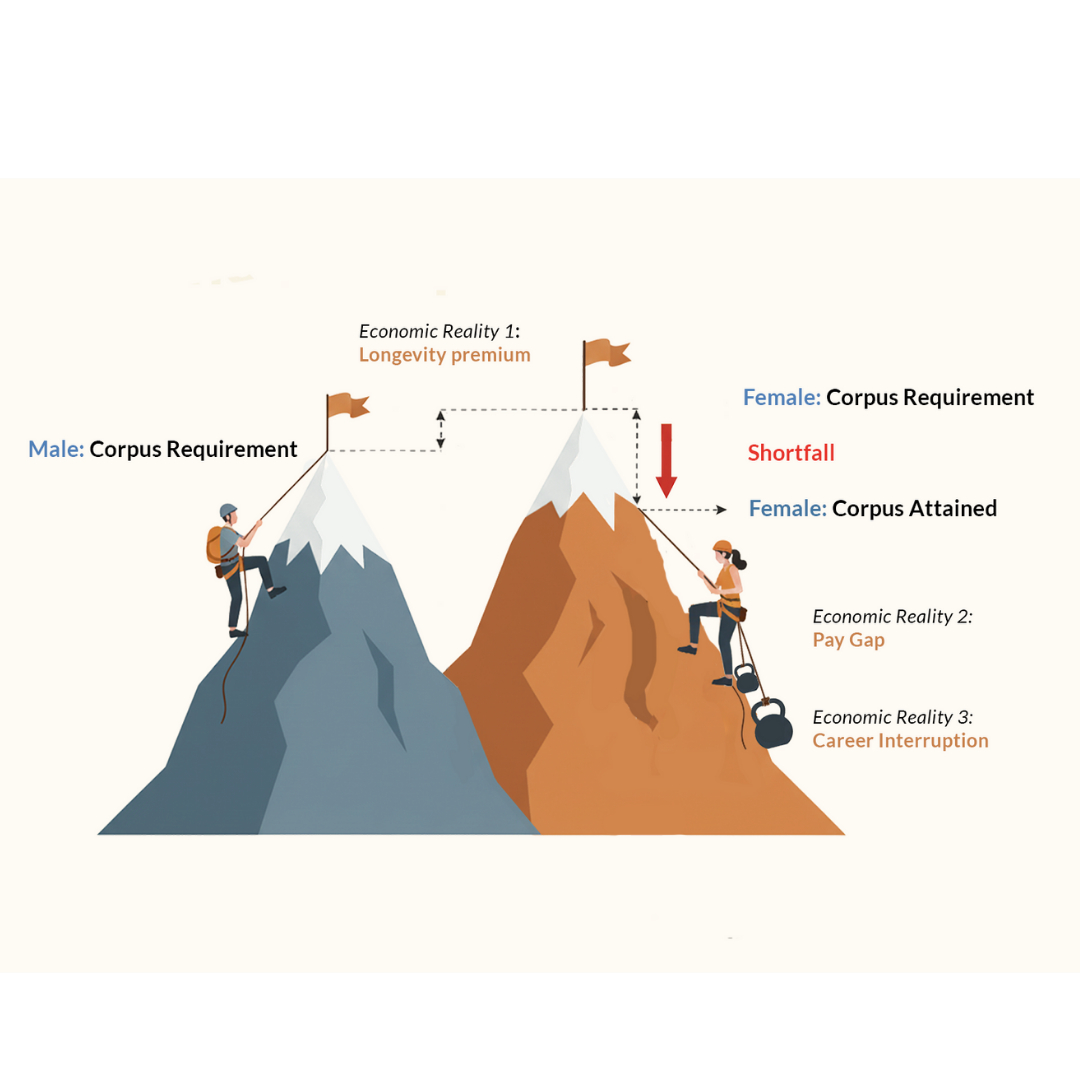

The Challenge

Women’s financial journeys are powerful—yet often interrupted by responsibilities, transitions, and systemic gaps.

The Gap

Your plan is custom-architected, designed specifically for your unique circumstances and objectives.

Our Solution

To bridge that gap with personalised planning, thoughtful advice, and a safe, empowering space.

Women Need a Different Approach

Women are demonstrably goal-driven, long-term investors, exhibiting an innate preference for capital stability and compound growth. This internal discipline creates powerful wealth-building potential.

Yet traditional financial planning often overlooks the unique pressures and realities that shape women’s financial journeys. From systemic pay gaps to extended longevity, women face distinct challenges that demand specialized strategies and tailored solutions.

Longevity Planning

Women live an average of six years longer than men, requiring financial plans that sustain you through extended retirement years.

Your portfolio must work harder and last longer, demanding strategic planning that accounts for decades of post-career life with confidence and security.

Wage Gap

Every rupee must be optimized through smart investing, tax efficiency, and strategic growth planning to bridge this structural disadvantage.

Career Interruption

Career breaks for caregiving—whether for children, aging parents, or family needs—significantly impact lifetime earnings and retirement readiness.

These transitions require proactive planning, bridge strategies, and thoughtful portfolio management to protect your financial future during periods of reduced income.

Investment Confidence

Women tend to invest more conservatively than optimal, potentially missing significant growth opportunities that compound powerfully over decades.

Building confidence through education and personalized guidance helps unlock the full wealth-building potential you deserve without unnecessary risk.

Wealth Management Tailored for Women

We offer integrated financial solutions that adapt to every stage of your life, ensuring you have the support and strategy you need when you need it most.

Holistic Financial Planning

Comprehensive strategies that integrate retirement, estate planning, tax optimization, and philanthropic goals into one cohesive roadmap for your future.

Personalized Investment Management

Portfolio design built around your specific risk tolerance, time horizon, and life stage—ensuring your investments work as hard as you do.

Life Stages & Transition Support

Specialized guidance through major life events: divorce, inheritance, widowhood, career changes, or business ownership—we're with you every step.

Empowering through Financial Education

Access regular updates, insights, knowledge-sharing sessions, and peer learning through intentional community building. .

How We Work Together ?

Our proven process ensures your financial plan is both comprehensive and deeply personal. We take time to understand not just your numbers, but your dreams, values, and vision for the future. This collaborative approach creates strategies that truly reflect who you are and where you want to go.

Deep Discovery

We begin with understanding your life, goals, values, time horizon, and risk profile through comprehensive conversations.

Personalized Strategy

We craft a customized financial plan tailored specifically to your unique circumstances and aspirations.

Seamless Execution

We help you set up and execute your investments smoothly with clear guidance at every step.

Ongoing Partnership

Life changes—and so does your plan. We review and refine regularly to keep you on track.

How Will You Shape Your Tomorrow?

Discover investment strategies crafted around women’s goals. Take the next step toward confident financial independence.